Ethical investing involves aligning your investment portfolio with your moral compass. So if you are worried about investing in companies that do not align with your ethical codes, then ethical investing is the right path to follow. Therefore, the simplest definition for ethical investing is a kind of investment approach whereby investors decide to invest based on personal ethical considerations.

Some of the industries that ethical investors seek to support are the ones that have the maximum positive impact. Ethical investment funds such as ESG, socially responsible mutual funds, faith-based funds. And impact funds have made ethical investing much more accessible. Below is a guide on how to invest ethically.

Table of Contents

Decide How You Want to Get Involved

When creating an ethical investment portfolio, there are two ways in which you can begin, the first one is choosing an ethical investment expert to do it for you, and the second way is doing it yourself. When doing it yourself, you simply pick certain ethical investment funds and monitor their performance over time.

According to the definition for ethical investing, doing it yourself is the best approach because you are very sure that you have selected what is ethical. If you have already opened a brokerage account, it is easier to choose suitable funds with the help of the already available screening tools.

However, if you feel like creating an ethical investment portfolio is too much work, you can always seek help from experts. Most ethical investment experts use an algorithm-based approach when creating your portfolio. The algorithm can balance your goals while considering risk tolerance for your investment.

Be Clear On What Is Ethical and Unethical for You

The second step when doing it yourself comes after choosing an investment firm or opening a brokerage account. Here you need to weigh out if particular companies are still ethical or unethical for you in this regard. For instance, upon weighing the fossil fuel industry based on various metrics, decide whether they still matter in your investment strategy.

Choose Ethical Investments Supporting Your Goal

Since you have a clear definition for ethical investing, it is now easier to choose your priorities. Here you begin building a portfolio that aligns with your ethical values. You can look at reviews from trusted research firms about each company listed in the investment.

You will get insights about individual companies’ environmental, social, and governance issues scores. Mutual funds and individual stocks are the two significant investments you can consider. However, mutual funds are the best way to start investing ethically as they give a better chance to diversify your investment portfolio. You can invest in several companies that fall under the same fund according to specific selection criteria used by your fund manager.

Summary

The most straightforward definition for ethical investing is a kind of investment approach whereby investors decides to invest based on personal ethical considerations. To start investing ethically, you need to decide how you want to get involved, clearly understand what is ethical, and then choose the investments that support your objectives.

Related posts

Featured Posts

What is Shiba Inu Coin? – Price, buy, and More

Shiba Inu coin launched in August of 2020, but it only recently enjoys enormous growth. And some crypto fans expected…

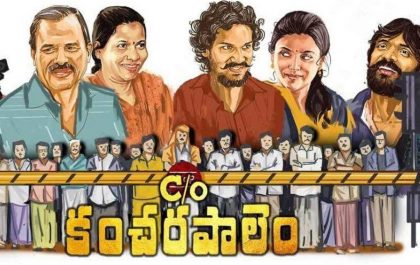

Watch and Download C/o Kancharapalem (2018)

C/o kancharapalem Movie Download C/o Kancharapalem is the 2018 Telugu-language slice of life anthology film written and directed by debutant…