Bitcoin Write For us – The new computer world welcomed writers passionate about writing and contributing posts on our website. We are looking for a writer who has talent and experience. Our main goal is to provide our reader accurate information related to Bitcoin and Cryptocurrency. Moreover, Cryptocurrency is digital currency Thus, we want repleted on bitcoin, Crypto. If you are writer, then most welcomed to our website, please send us your email at contact@newcomputerworld.com

Benefits of Publishing Article on New Computer World

- A place to share your opinions with the world

- Reach our global audience of readers

- The opportunity to connect and engage with our worldwide community of partners and leaders in the New Computer World.

- Your promise is flexible and you can submit content as per your schedule

What are you looking For?

We love to find writers who are passionate about blockchain technology and want to share their interesting thoughts on New computer world and any news they find valuable. New computer world News is looking for like-minded people to help filter out all the noise in the space and highlight the most valuable content for readers.

Do’s

- Creative and interesting opinions on anything blockchain related

- Valuable Insights into the Uses and Application of Blockchain Technology

- News and analysis for current events in the blockchain sector

- Information about the constantly evolving blockchain regulations in different authorities

- Content related to technical areas of newcomputerworld.com technology is highly welcomed

Don’t’s

- Any content that is considered promotional/marketing material for other projects

- Content that is not the original work of author or is copied

- Any offensive or insulting thought that has malicious intent

Factors that Affect Bitcoin Price

The bitcoin price has grown exponentially over a decade, rising from less than $1 in 2011. It was first made available to the public in 2009. The price of bitcoin is primarily affected by its relative scarcity, market demand, supply, the marginal cost of production, and competing cryptocurrencies.

And also, if you want to know more about the progress of Bitcoin, it is essential to read financial websites. You can follow the latest financial news on Fastball to get more Bitcoin updates. contact@newcomputerworld.com

Covid Crisis

The COVID-19 crisis sent commodity prices to some of their lowest levels in early 2020. US oil futures traded negative in April 2020. However, as economies recovered, energy prices rose at a rapid pace. Geopolitical tensions in Europe have also pushed up natural gas prices.

The global recovery and cold weather are boosting demand as oil-importing countries need to replenish their inventories. Strong demand, disrupted supply, and low stocks pushed oil prices to their highest in seven years. Brent Crude Futures rose from $3 to $108.00 a barrel, while Saudi Aramco went propane and butane prices to their highest level since 2014.

Economic Growth

The upside of this development is that Saudi Arabia forecasts economic growth of over 7% in 2022. This year, the oil-rich kingdom’s banking sector, which emerged relatively unscathed from a difficult 2021, could also benefit from higher interest rates. Analysts expect economic growth to weigh on the banking system, supporting net income as consumption levels recover to pre-COVID times. Also, the US Federal Reserve rate hike, expected in March, will weigh on the yield theme.

High Mark

Although only a digital currency, Bitcoin is highly valued, with a total market capitalization of $1.11 trillion as of November 2021. The concept of virtual currency is still new, but Bitcoin is becoming every day less experimental with its growing popularity.

Speculative investors buy Bitcoin for its intrinsic value rather than its ability to act as a medium of exchange. However, the lack of a guaranteed deal and its digital nature mean that its purchase and use carry several inherent risks, primarily since it is not issued or regulated by government monetary policies.

Also several factors explain why Bitcoin has such a volatile price history. Understanding its market price can help you decide whether to invest in it, trade it, or continue to monitor its progress.

Supply and Demand

Like any commodity, the price of Bitcoin is influenced by supply and demand more than any other factor. Its market values it’s mainly determined by the number of coins in circulation and the amount people are willing to pay. The cryptocurrency is limited to 21 million coins. Therefore, the price of Bitcoin is likely to fluctuate in response to the actions of prominent financial players vying for ownership of Bitcon’s declining supply.

Investor Actions

Speculation on price movements plays a vital role in the value of Bitcoin assets at any given time. The demand for Bitcoin has increased as the supply is increasingly limited. These investors are also behind Bitcoin’s volatility. It is also driven partly by various beliefs about its usefulness as a store of value and a method of transferring value. You can use it as an inflation hedge and an alternative to traditional assets like gold or other metals.

Also Read: Server Guide for Dummies

How to Submit Your Article?

Once your article meets our guidelines, you can send it to contact@newcomputerworld.com

Why Write For Us at NewComputerWorld – Bitcoin Write For us

Topic You can write for us

digital currency

bitcoin network

nodes

cryptography

distributed ledger

blockchain

cryptocurrency

Satoshi Nakamoto

open-source software

mining

carbon footprint)

price volatility

speculative bubble

economic bubble

Nobel Memorial Prize in Economic Sciences

the central bank of Estonia

Ponzi scheme

Search Terms for Bitcoin Write For us

Guest post

Looking for guest posts

Become a guest blogger

Guest posting guidelines

Become an author

Submit post

Suggest a post

Guest blogging + “write for us.”

Write for us + guest blogging

Guest post

Contributor guidelines

Contributing writer

Guest blogging + “write for us.”

Write for us + guest blogging

Guest posting guidelines

Become a guest blogger

Become an author

Suggest a post

Submit post

Computer Write For Us

carbon footprint) Write For Us

price volatility Write For Us

speculative bubble Write For Us

economic bubble Write For Us

Nobel Memorial Prize in Economic Sciences Write For Us

the central bank of Estonia Write For Us

Ponzi scheme Write For Us

Write for us other cryptocurrencies

Write for us transaction

line of business Write for us

Write for us strong cryptography

Write for us public cloud

Visible Write for us

consumerized IT Write for us

Write for us arbitrage

Write for us distributed ledger

Guest post

Contributor guidelines

Contributing writer

Guest blogging + “write for us.”

Write for us + guest blogging

Guest posting guidelines

Become a guest blogger

Become an author

Suggest a post

Submit post

Write for us tech

Writers wanted

Write for us blogging

Submit an article

Write for us

Guest post

Looking for guest posts

Become a guest blogger

Guest posts wanted

Writers wanted

Guest posting guidelines

Become an author

Submit post

Suggest a post

Guest blogging + “write for us.”

Write for us + guest blogging

You can Find Us

Crypto write for us

You Can Find

Bitcoin write for us free

Bitcoin write for us app

write for us + cryptocurrency paid

write for us blockchain

”guest post”+crypto

write for us nft

write for us web3

want to write for crypto

Write for us cryptocurrency paid online

keyword: Write for us cryptocurrency paid free

Write for us cryptocurrency paid app

keyword: Write for us cryptocurrency paid reddit

write for us blockchain

”guest post”+crypto

want to write for crypto

keyword: write articles for crypto

Write for us blockchain free

keyword: Write for us blockchain app

write for us + cryptocurrency paid

”guest post”+crypto

write for us nft

want to write for crypto

defi write for us

write articles for crypto

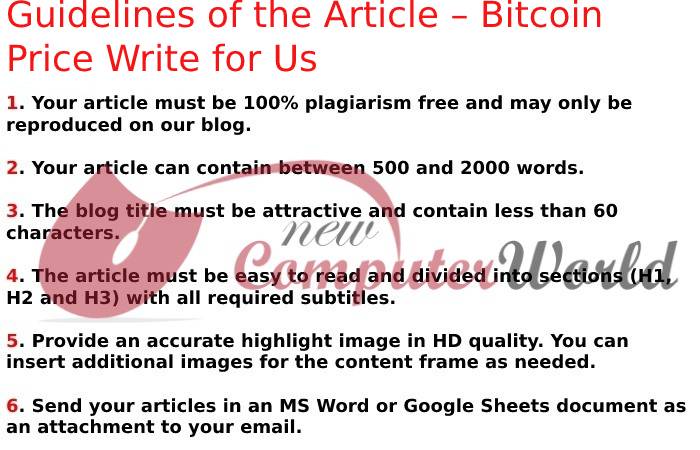

Guidelines of the Article – Bitcoin Write For us

To Write for Us. Also, you can email us at contact@newcomputerworld.com

Related Pages To Bitcoin Write For us

proxies for web scraping write for us

workplace accidents write for us

bitcoin or cryptocurrency write for us

essential content marketing write for us

innovative seo practices write for us

lucrative cryptocurrencies write for us

staying productive write for us